Head Office in Sweden.

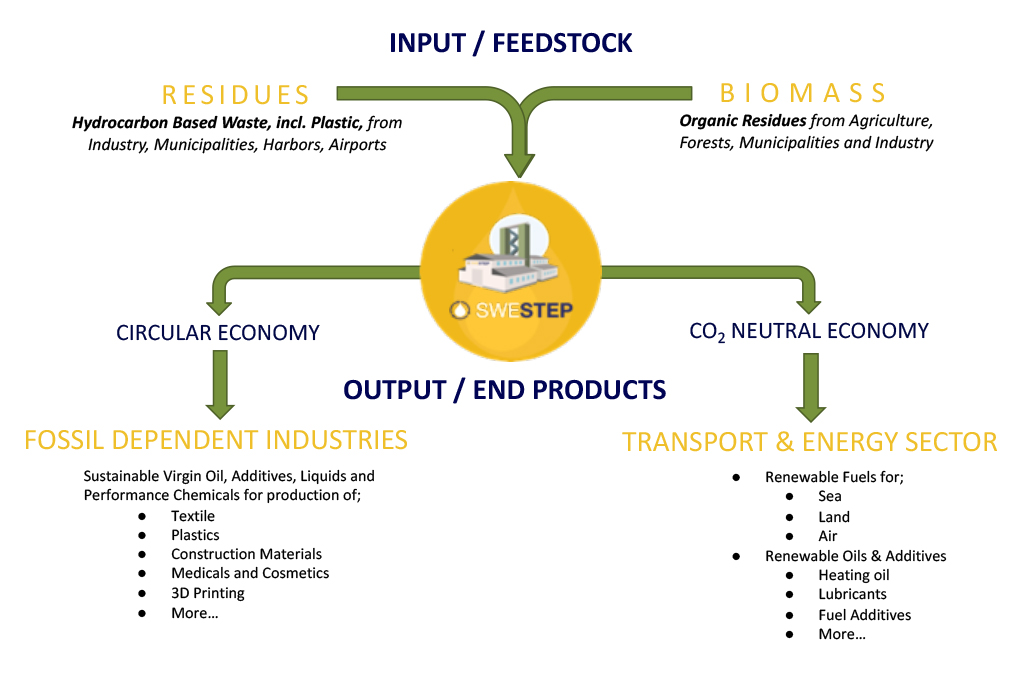

A Turnkey Facility Solution which encourages fossil independence using all kind of Organic and Plastic Residues as Feedstock

SWESTEP's Proven Technology is Capable of Converting Waste and Residues from Municipalities, Forestry, Agriculture, Ports and Industries into Renewable Fuels and/or Oils for the Transport, Energy and Chemical Sector.

The End Product can also be Valuable Raw Oils for Fossil Dependent Industries to produce Sustainable Liquids and Performance Chemicals for production of Green Textile Fibers, Polymers that can help both the Plastic and the Fashion Industry "Closing the Loop".